Most founders believe that getting funded validates their business, however, nothing could be further from the truth these days.

Due diligence is no longer something venture capitalists invest heavily in at early-stage. There was a time when they cared more than they do today, but for the most part, those times are long gone.

Today what VCs care about is deploying capital as quickly and as wisely as possible, to founders and products that tick certain boxes, so both the due diligence and level of support they offer founders is not what it used to be. Whilst I’m sure some will claim they are the exception to this rule, I tend to bucket them all as one, and hope I’m pleasantly surprised when I find the exception to the rule.

Speed of growth expectations remain very real

One thing hasn’t changed in venture though and that’s the speed of expected growth post a funding round. VCs investing at series A are now even more expectant than in the past, looking for back-to-back years of 3x ARR growth or more.

No longer is being a unicorn ($1bn valuation) the holy grail, now being a decacorn ($10bn valuation) is the holy grail, and no doubt at some point in the next few years it will be a centacorn ($100bn valuation) - I just made that word up but you get my drift!

So here’s the challenge for founders: there’s more money flushing around the system than ever before, it’s easier to get at than ever before, the due diligence is nowhere near what it used to be, and yet VCs still expect hyper-growth once funded.

The result is founders taking series A prematurely because they can get at the money easily, but they are doing so when their company is not ready to 3x or more ARR, and they are then faced with having to retrospectively fix things quickly - or just bury their heads in the sand and grind into the abyss.

Scaling too early can prove fatal

In SaaS, fixing “things” quickly is a tough gig, especially in enterprise SaaS which has long sales cycles and somewhat more demanding customers.

It’s not unusual for me to see Series A funded companies, that by my estimation have not quite nailed product-market fit, but yet are making the case to their investors and their internal team that they’re ready to scale their sales org.

This is often a fatal error.

The one thing founders should not do in this situation is bury their heads in the sand and just press on regardless - that’s a massive train crash waiting to happen.

My advice to founders that have taken series A somewhat prematurely is to be honest with themselves, go back and identify the gaps in their GTM motions and playbooks and hire experts to help them ably fill those gaps, so they can sustainably step on the gas for years to come.

Most first-time founders, especially those from a product and engineering background come unstuck at this point, and truly struggle.

100 Playbooks

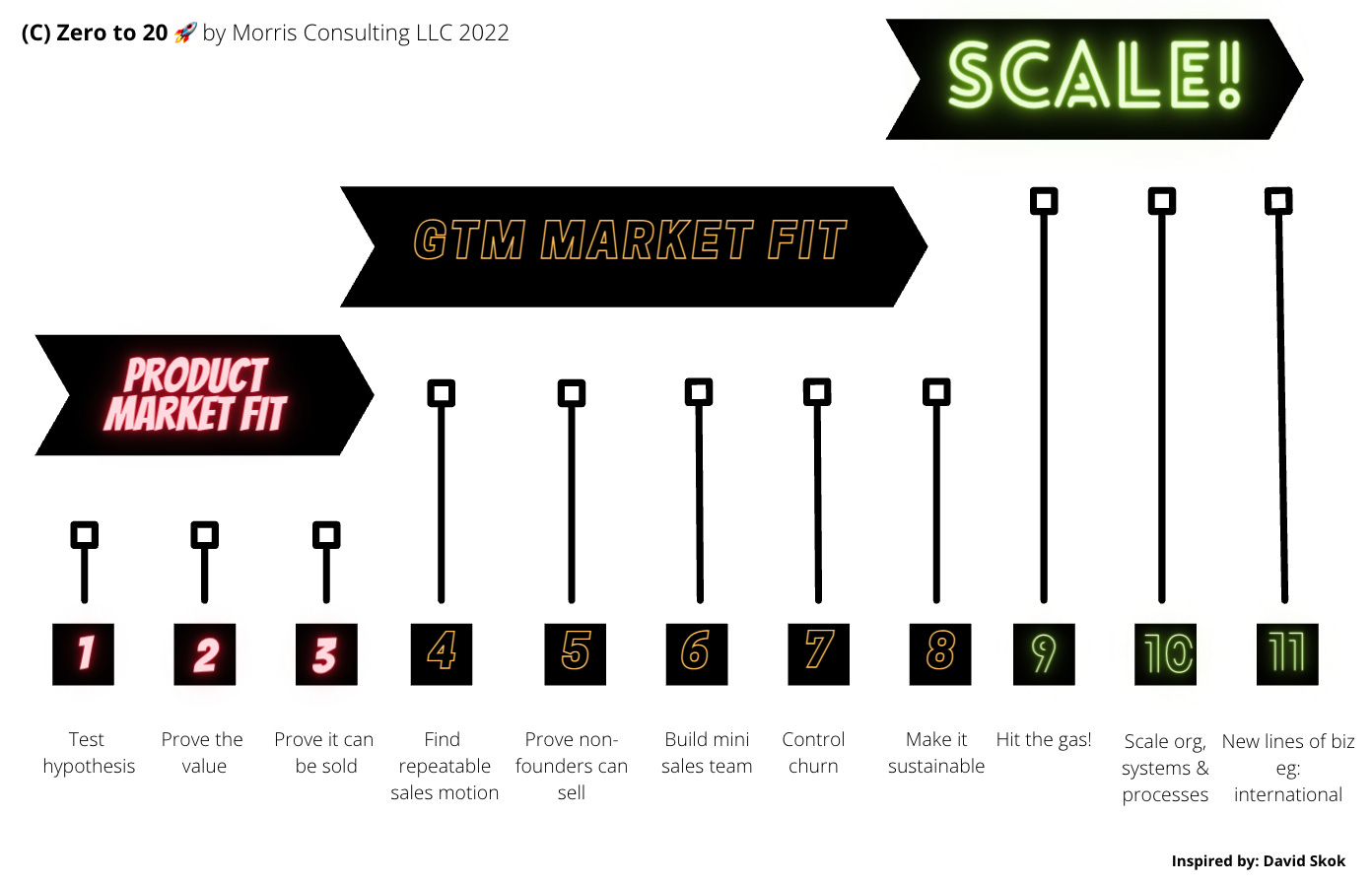

By my estimation, and that of people like David Skok at Matrix Partners who I have followed religiously over the years as I’ve built GTM teams of my own, is that there are over 100 GTM related playbooks that need to be created before series A, and at least 9 distinct stages of growth a startup needs to successfully exit to truly be sustainable and able to scale.

If you’re a founder or working with a founder that cannot clearly direct you to a series of playbooks that have been built and iterated, it’s time to backtrack, build those playbooks, and use them to get the market feedback you require to ensure you have de-risked your startup by successfully exiting each stage of growth.

It’s not impossible to scale without methodically building playbooks, but you’ll burn a lot less capital, grow faster and much more organically if you those playbooks are written.

My advice for founders in a tough spot

To those founders that know they have gaps, here’s my advice:

1. Find someone to run a sales maturity audit with you.

They will determine how mature your sales processes are, where the gaps are, and offer you guidance on where to focus first to close the gaps.

This audit alone will not only enable you to sleep easier and give you practical steps about how to de-risk your startup, but the outcome of the work will also likely increase your valuation by multiple $millions - so there is no doubt it’s worth the money, with the right consultant.

2. Commit to doing the work

The audit will highlight the gaps you have, but it won’t close those gaps. Closing those gaps is what comes next. Additionally, you should not allow your consultant to close the gaps for you. They should be your guide and you and your team should co-author the playbooks and test and iterate those playbooks yourself with your consultant coaching you through it.

Co-authoring with you or your team as the lead is critical. It’s the best way to transfer the knowledge of the consultant to the founder and your team as quickly as possible. So, you must commit to the work.

3. The outcome of this work is huge - make the investment

The first phase of the work post the audit will increase your valuation by multiple $millions, however the outcome of the extended work with your GTM advisor will increase your valuation by $10m+, so again, whilst it’s a time commitment and likely a $100k+ investment if you invest in a top advisor/consultant, the value exchange will be worth it, and then some!

To sum up

Capital is easier to come by these days than ever before, but fast and sustainable ARR growth is as challenging as it’s ever been. That said, there are people out there that have done this before, and have codified a process for you to follow, and will prove invaluable sounding boards for the unique nuances your startup will face.

If you’ve taken funding, you’d be hard-pressed to find a better use of your $ than hiring someone to sit alongside you and your VP of Sales to ensure you nail go-to-market once and for all.

Good luck folks, you’ve got this! 👊🏼

Wayne

Advising: WayneMorris.co

LinkedIn: WayneMorris

Twitter: @waynegmorris

Newsletter sign-up: WayneMorris.me